This morning, if I say anything that’s not about the election, no one will read this. (Though if you want to hear something unrelated but comical: Today is my birthday.)

And I’m writing this before any of us know the outcome of what has been a roller coaster-contentious election, especially in Silicon Valley. We could have answers by tonight. But if the last few elections are any indication, it’s distinctly possible we won’t.

I turn to history when I don’t know what to say. I always have—ask my friends, who after enough beers, will usually say something like: “Allie, please, not Napoleon’s invasion of Russia again.”

But today, looking back may actually be useful. You can read about the present elsewhere and everywhere, so right now I’d like to talk about the past.

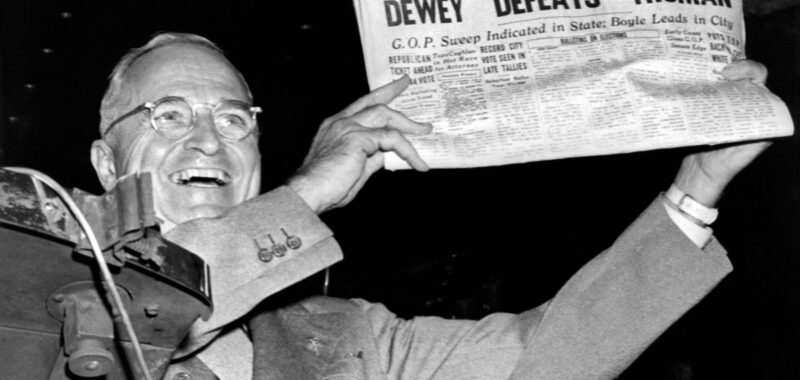

Close, chaotic, and contested elections have long been a recurring part of American politics. I’ve always been drawn to that 1948 photo of Harry Truman, Cheshire Cat grin, holding up the Chicago Daily Tribune and its screaming front page: “Dewey Defeats Truman.” (Spoiler alert—he did not.)

Though there are many examples that are less amusing. In 1824, Andrew Jackson received the most popular and electoral votes, but didn’t win the majority. The decision fell to the House of Representatives, where a string of backroom machinations made John Quincy Adams president and distant runner-up Henry Clay the Secretary of State. Jackson furiously termed it the “Corrupt Bargain,” stepped aside, and then came blazing back as a populist candidate in 1828.

The election of 1876 was even worse, and over two names most Americans today will hardly recognize: Republican Rutherford B. Hayes and Democrat Samuel J. Tilden. Hayes ultimately won even though he lost the popular vote by more than 250,000 votes, and the outcome was so virulently divisive that some feared it would lead to another civil war. But it didn’t.

And then there’s the one all of us remember.

Every election cycle, my husband has a story he likes to tell about his first-grade election night assignment—he had to fill in the 2000 Bush vs. Gore electoral map. (I asked him whether he did it in crayon, but he couldn’t recall.) As the night went on he filled in some states red, others blue. When it was bedtime, his parents—my now in-laws—told him to call it a night. He protested: “I have to finish my homework or I’ll get in trouble!”

His Silicon Valley doctor parents told him: “Honey, no one is finishing their homework tonight. And somewhere in Florida, there’s someone in much bigger trouble than you.”

I was in Florida, a kid watching my own parents glued to the TV for that night—then for weeks. We lived in the Miami-Dade County that was all over the news, with incessant talk of hanging chads. But for all the hullabaloo, I don’t remember feeling like we were in trouble. My parents were uncertain, yes, alarmed, yes. But afraid? I didn’t sense that my parents were truly fearful of what might happen—or that they thought I should be. Much has changed since then: January 6 revealed how quickly things can get out-of-hand.

Like many of you, I believe this is an important election, but I also have to believe it’s not wholly unprecedented. I personally find solace in the idea of being part of a long continuum, and I hope that gives some of you comfort, too. And sure, I could be thinking about this all wrong (my husband thinks so). But what I know today, before the votes are tallied, is that close, chaotic, and contested elections have long been part of the American system.

And that democracy endures through the peaceful transfer of power.

Go vote and see you tomorrow,

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

VENTURE DEALS

– Miros, a London-based visual AI search platform for shoppers, raised €6 million ($6.5 million) in pre-Series A funding. EBRD Venture Capital and Tera Ventures led the round and were joined by angel investors.

– Further, a remote financial planning platform for first-time homebuyers, raised $4.1 million in pre-seed funding from Link Ventures, Vesta Ventures, F4, angel investors, and others.

PRIVATE EQUITY

– Stonepeak agreed to acquire Air Transport Services Group, a Wilmington, Ohio-based aircraft leasing and cargo and passenger air transportation solutions provider, for approximately $3.1 billion in cash.

– Aero Accessories & Repair, a portfolio company of ATL Partners, acquired Aero Instruments and Avionics, a Buffalo, New York-based avionic and instrumentation services provider. Financial terms were not disclosed.

– Comvest Private Equity acquired a majority stake in Riccobene Associates Family Dentistry, a Cary, N.C.-based dental services organization. Financial terms were not disclosed.

– H.I.G. Capital and Thoma Bravo agreed to acquire the brand and products of the Computing Technology Industry Association, a Downers Grove, Ill.-based IT certification and training provider. Financial terms were not disclosed.

– Littlejohn acquired Sunbelt Modular, a Phoenix-based modular solutions designer and manufacturer. Financial terms were not disclosed.

– Monomoy Capital Partners acquired Oliver Packaging and Equipment, a Walker, Mich.-based food packaging systems and bakery equipment manufacturer. Financial terms were not disclosed.

– Renovus Capital Partners acquired a majority stake in Performive, an Atlanta-based managed IT services provider for mid-market enterprises. Financial terms were not disclosed.

– SK Capital Partners acquired the North America Composites and Fuel Containment division of Parker Hannifin Corporation, a Cleveland, Ohio-based motion and control technology company. Financial terms were not disclosed.

EXITS

– AMETEK acquired Virtek Vision International, a Waterloo, Canada-based laser projection and AI-powered inspection solutions provider, from American Industrial Partners. Financial terms were not disclosed.

– Domtar Corporation acquired the North American paper receipt solutions business of Iconex, an Atlanta-based label manufacturer, from Atlas Holdings.

– Ryan Specialty acquired Innovisk, a London-based investment and insurance firm, from Abry Partners and BHMS Investments. Financial terms were not disclosed.

– 1440 Foods, backed by 4×4 Capital and Bain Capital Private Equity, acquired FITCRUNCH, a Bohemia, N.Y.-based protein bar company, from Robert Irvine, Union Capital Associates, and its founders. Financial terms were not disclosed.

OTHER

– Apple agreed to invest $1.1 billion in GlobalStar, a Covington, La.-based satellite services provider. Apple also agreed to acquire a 20% stake in the company for $400 million.

– Kewaunee Scientific Corporation acquired Nu Aire, a Minneapolis-based laboratory and pharmacy equipment manufacturer, for $55 million.

– Lincoln International acquired TCG Corporate Finance, a Munich-based technology and digital economy advisory firm. Financial terms were not disclosed.

– Mercer acquired Cardano, a London-based investment management and advisory firm. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

– Shamrock Capital, a Los Angeles-based investment firm, raised approximately $1.3 billion for its sixth fund and approximately $320 million for its first fund focused on buyout and later-stage investments in middle market companies in the media, entertainment, and communications sectors.

PEOPLE

– Arsenal Capital Partners, a New York City-based private equity firm, added Joshua Schultz as an operating partner. Previously, he was at Cytel.

– Silversmith Capital Partners, a Boston-based growth equity firm, added Chris Hecht as an operating partner. Previously, he was at Databricks.