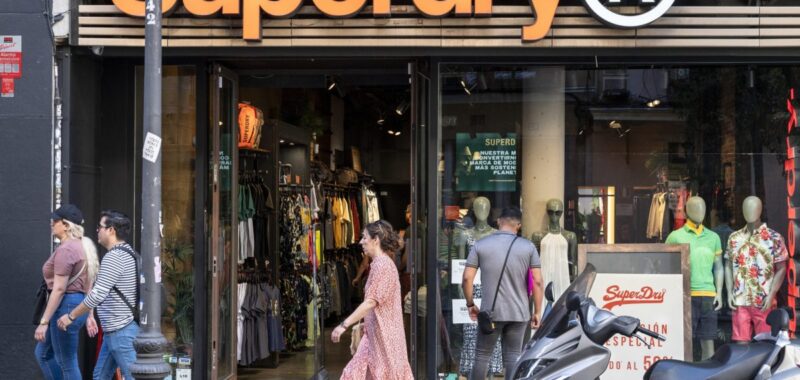

Not long ago, Superdry was soaring through profit highs as consumers sought the brand’s hoodies and puffer jackets out, propping up its shares.

The English apparel brand, founded about 20 years ago and identified with its signature Japanese scribbles, has been nothing less than a cult. The average Brit was just as likely to sport a Superdry garment as David Beckham.

But now, Superdry’s dream-run might have fizzled out.

The retailer plans to delist from the London Stock Exchange to shore up its finances to help it stay afloat, according to a statement released Tuesday. It plans to raise more funds, cut costs from rent and extend its loans to revive the company’s core business to new glory.

Superdry has dealt with mounting losses, a slew of CFO departures and a rapid decline in share price, which is down 82% year to date. The company has been battered by a variety of factors, most recently the cost-of-living crisis hurting shoppers’ purchasing power.

Its revenues for the first-half of the current financial year were down 23.5%, while its losses last year amounted to £148 million ($184 million).

About two months ago, Superdry first said it was exploring taking itself private under CEO and cofounder Julian Dunkerton.

The goal of the restructuring plan would be to put “the business on the right footing to secure its long-term future following a period of unprecedented challenges,” Dunkerton said in a statement.

“Once something of a market darling as it rode a wave of consumer demand for its faux-Japanese stylings, Superdry has been firmly out of fashion with investors,” AJ Bell’s head of financial analysis said in a note on Tuesday.

“The hope will be the company can restore its ailing brand to health out of the glare of the public markets.”

Superdry plans to raise up to £10 million ($12.4 million) in equity as part of the drive. If its overhaul proposal fails to take off, Superdry will have to pursue insolvency, it warned.

Rumblings about the British retailer’s future have put the company under pressure to gain its past allure with customers. Before the close of 2023, Superdry’s shares slumped when its sales plunged owing to an “abnormally mild autumn.” It also issued a profit warning at the time, despite efforts to put a lid on spending and shutting its U.S. wholesale operations.

The problem of waning sales isn’t unique to Superdry, but it comes at a time when its financial future was hanging in the balance.

Superdry’s fall from grace

Superdry’s predicament follows shortly after The Body Shop, another British-based global consumer brand, went bust, shuttering all its stores and resulting in hundreds of job cuts.

Intelligence company Knight Frank likened the two brands because they have both been examples of “cottage industry on a stratospheric path to global brand status.”

The sharp fall from grace over the past few years has been hard to miss, despite efforts to salvage the company.

The group attributed Superdry’s tide turning to the fad-like nature of fashion, which the brand didn’t keep up with to stay relevant. Adding to its woes, its rapid expansion in different parts of the world during the peak of its success made matters worse.

What happens to Superdry following its big overhaul remains to be seen. But it has to desperately turn itself from a fleeting fashion phenomenon of the past to one that’s still fresh for its customers if it hopes to thrive again.