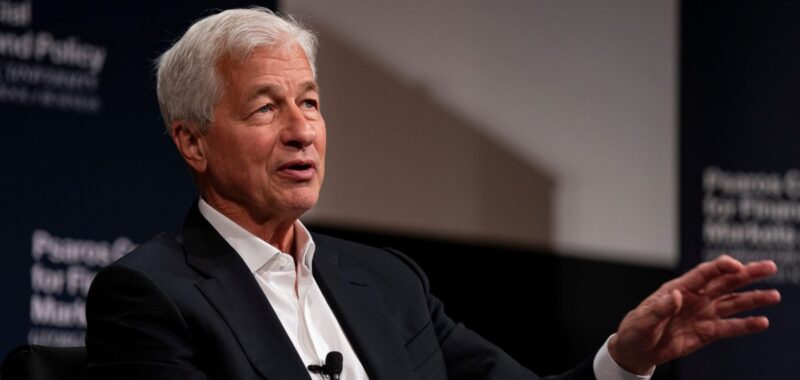

JPMorgan CEO Jamie Dimon has always been an advocate of looking at the big picture—and he sees a shifting balance of power between major world economies as the U.S. looks to minimize its reliance on China.

In an interview released this week, Dimon suggested America’s diversification away from China offered an opportunity to a major, emerging economy: India.

Speaking to CNBC-TV18 from JPMorgan’s India Investment Summit taking place in Mumbai this week, Dimon outlined that from a national security perspective America was “overly reliant” on China and should be trying to take a step back.

“That’s not being angry at them, you should ask why we didn’t do it before,” Dimon added. “But in terms of rare earths, semiconductors, penicillin, ingredients for pharmaceuticals—obviously every nation will look at this and say ‘We can’t rely on someone who might one day be an adversary—that doesn’t mean they’re an adversary today—for supply.’”

The second issue with America’s relationship with China, Dimon added, is that the latter nation is attempting to dominate global industries.

To thwart this aim, the Biden administration has doubled tariffs on Chinese chips from 25% to 50%, and quadrupled tariffs on Chinese electric vehicles from 25% to 100%.

These deterrents have been coupled with massive U.S. government investments in industries where America wants to better compete.

The souring relations have also pushed companies like Apple to reportedly increase the production of products such as iPhones in India as opposed to China.

Long-time warnings

Dimon has been warning of the impact of geopolitics on the global economy for years.

Whether it’s Russia’s invasion of Ukraine, violence in the Middle East or tensions with China, the 68-year-old CEO is monitoring how close these issues are to spiraling into an economic disaster.

While tensions with China are far from any military conflict, the Wall Street veteran has warned that America’s reliance on the nation has become a problem.

In his 2023 letter to the bank’s shareholders, Dimon said China had stealthily established itself as a global powerhouse while America “slept.”

And while Uncle Sam doesn’t have to fear China—indeed it doesn’t have to see it as a rival at this point—Dimon is cautioning that the U.S. may want to extract itself from some of the supply chains which have become engrained in its economy.

Not only is reliance on another nation a bad idea in general, but the JPMorgan boss has also outlined that China’s support of Russia’s war in Ukraine, for example, signals it is on the “wrong side” of the global division.

China +1 strategy

The fact that Big Tech firms like Apple are already shifting out of China to India is indicative of a wider opportunity, Dimon said from JPMorgan’s India Investment Summit.

Some shifts will happen more quickly than others—production of semiconductor chips, for example, will take years to shift away from China he added.

“A huge opportunity for India,” Dimon added. “People call it the China+1 strategy. Companies that solely relied on China are looking at India, Vietnam, Malaysia, Indonesia etc.”

Private companies are having to react to public policy, with Dimon adding that whether Democrats maintain power in the Oval Office or hand the White House to the Republicans in November, relations with China will still be front of mind.

“Ukraine, terrorism in Israel, Russia, Iran aiding and abetting—China’s kind of on the other side to America on that one so it’s causing a lot of the tension. I think the better thing to do is fully engage, which they’ve done—our government—to try to protect ourselves and national security,” Dimon added.

“I think if the war goes on there will be contentious issues between the countries… so both sides will be fully engaged.”